Bridging Asia and the EU; we secure compliance with EU directives and regulations for non-EU aircraft owners and operators Any aircraft flying into the EU will fly under customs control using either the Temporary Admission (TA) procedure or full importation. There are no other options. If the aircraft is not already fully imported, the aircraft will automatically be considered as flying under the TA procedure even though the owner or operator has not taken any action or realized that their…

Resources

Solving operational risks for family offices – Finlight’s artificial intelligence (AI) and Natural Language Processing (NLP) solution Solving operational risks for family offices – Finlight’s artificial intelligence (AI) and Natural Language Processing (NLP) solution Why does Finlight exist? Current challenges in the family office and UHNWI industry Today, family offices monitor trillions worth of assets of all kinds. A typical family office may be linked with multiple GPs, asset managers, custodian banks and investment consultants. However, these portfolio data are…

By Stewart Paterson The EU-China Comprehensive Agreement on Investment (CAI) was concluded in principle on 30 December 2020 after seven years of negotiation. It is perhaps a one-of-a-kind deal aimed at balancing the existing asymmetric investment relationship, where Chinese companies enjoy a far greater freedom to invest in Europe than EU companies do in China. But would it be able to achieve its stated goals? This essay by Stewart Paterson, Research Fellow at the Hinrich Foundation, explores the background to…

The ocean covers the majority of our planet’s surface, holding 97% of all water and 80% of all life forms. Major ocean sectors such as tourism, shipping, fishing, aquaculture and marine renewable energy collectively contribute to a ‘blue’ economy, estimated by the Organisation for Economic Co-operation and Development (OECD) at a global gross value added of USD 1.5trn in 2010. This blue economy has been projected to increase to USD 3trn by 2030, with some ocean industries set to grow…

By: Rick Rowan CEO & Founder of NuroKor BioElectronics The past 12 months have been a challenging and uncertain time for all industries – none more so than the healthcare sector. And with England now in its third national lockdown and with the pandemic resulting in unrelenting strain on the National Health System (NHS), healthcare professionals are turning to innovation to ease the burden. The need for advances in technology to tackle the challenges impacting hospital and community care, is…

Written By: Gilles komi Maglo CEO & Founder of MES & DAK The Fintech firm for MSME’s development Gilles komi MAGLO – A jazz Pianist and Entrepreneur– one might assume that this is a rather unconventional combination. But, according to Gilles, when it comes to music and leading a business, there is a difference in what I do, but not in how I do it. In both roles, I share the same traits: discipline, resilience, a strong eagerness to learn…

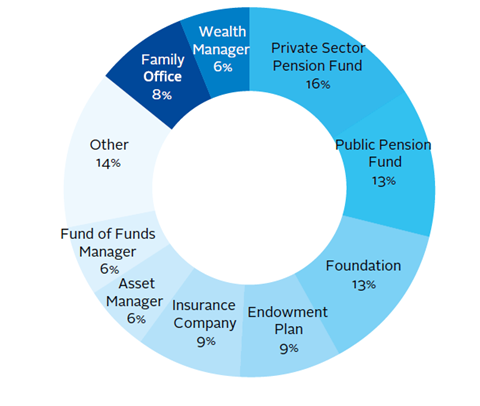

By Nicole Downer Managing Partner MV Credit Partners LLC Navigating Choppy Waters After working through an incredibly eventful year in the global economy, investors in private credit benefitted from the stable and consistent yields expected of the asset class. That was welcomed by investors, who went through a rollercoaster in the public markets. Private credit has grown from being specialist and niche asset class to a more established component of a diversified investment portfolio, from a sub $100bn asset class…

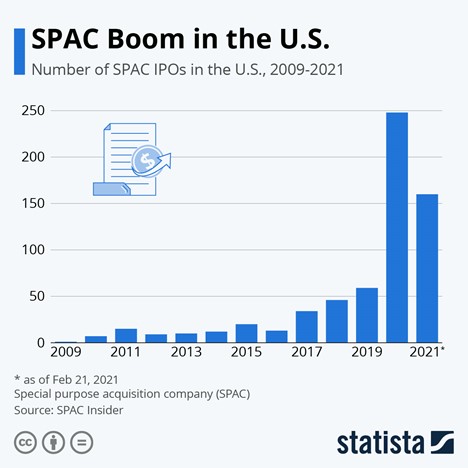

By Brad Lamensdorf of Active Alts Recently, SPACs, or the Special Purpose Acquisition Company segment of the stock market has grabbed a lot of attention from the media and investing public. The popularity of SPACs has transcended traditional operators and extended into hedge funds, sport stars, movie stars, and even civil rights activists, seeking to stake their claim to an ever-growing piece of the SPAC pie. Whenever a corner of the stock market captures the public’s attention to such a…

Click here to download the slide deck What are the priorities to ensure the region’s fast, sustainable and inclusive economic recovery from the crisis? Explore PBEC’s partner OECD’s latest and upcoming work in the region on competition, investment, SMEs and much more. Fostering Competition in ASEAN Efficient logistics can play a significant role in increasing a country’s economic development by facilitating international trade and improving its competitiveness. The Fostering Competition in ASEAN project reviews regulatory constraints on competition in all…

It’s a pleasure to have been asked to share my thoughts on the outlook for Fine Wine Investment in 2021. I do hope you enjoy reading this research, and find it enjoyable, interesting and perhaps above all though-provoking… Fine wine investments are on firm footing for the year ahead. A stable track record and growing geographic diversity form the basis of our positive outlook despite the challenging global backdrop as we head into 2021. The past year underscored that fine…